In today’s work environment, we must meet all sorts of expectations and deadlines, be constantly ahead of the game, excel in leadership, and at the same time be innovative and agile. And if you don’t have an environment where people feel safe to; be themselves, share their opinions, disagree with each other, and take risks, it’s very hard to achieve any of those things.

How saving 2€/day made me save 5427€ in 4 years

For most of my life, I haven’t saved much. Instead, I’ve been winging it. If I had money, I spent it. If I didn’t, I would find a way to make some. And if something unforeseeable happened, I was in a bad spot.

And before having kids, I really had no reason to save money because I wasn’t too worried about the future. Call me naive but I was simply happy without a hefty savings account.

Some people save because it gives them a sense of security. Others because they have big plans for the future. When I had kids, I noticed a need to be a bit more responsible and grown-up, and having a financial safety net was my way of satisfying that need. Suddenly I motivation.

But I knew I wasn’t going to be able to suddenly put away a lump sum each month as that had never worked before and we didn’t have much money left at the end of the month to put away really. Then I saw this quote by James Clear:

If you're having trouble changing your habits, the problem isn't you. The problem is your system. Bad habits repeat themselves not because you don't want to change, but because you have the wrong system for change.

I, like many people, thought that to save money I needed to put away a significant amount each month for it to get me anywhere. That approach hadn’t worked so far. I needed a different system.

Having had some success implementing other habits, I had also learned that small changes can have a huge impact if you can just stick with them long enough.

So I had an idea. What if I just save a tiny bit each day and stick to it for 10 years? And at the end of each quarter, I take whatever I have and invest it so it can grow. If I do that over and over again for a couple of years, maybe I would eventually have my grown-up safety net?

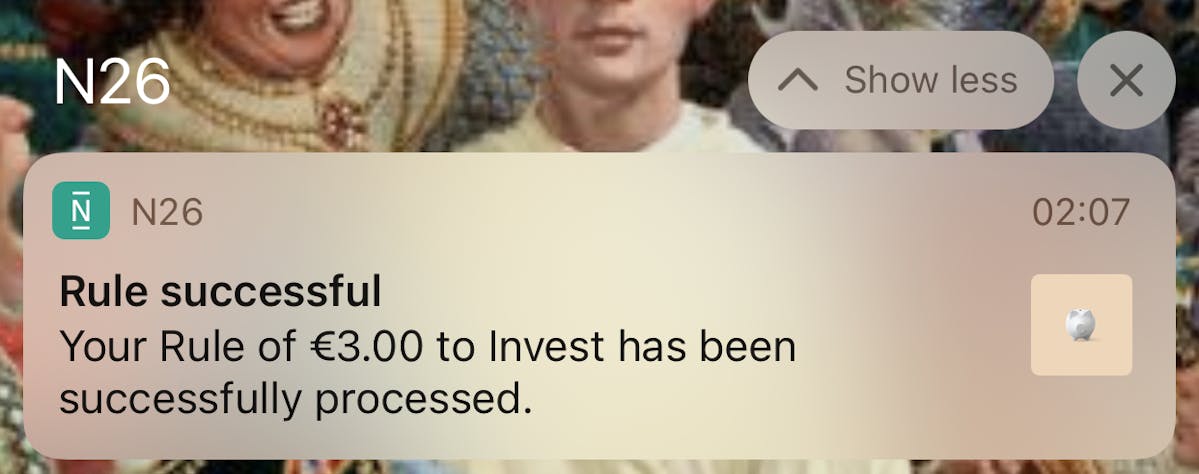

I set up an automatic transfer of 2€ each day to a savings account and since then, each morning I wake up to this message (I’ve since increased it to 3€/day):

It’s a nice little reminder each morning that I’m (very) slowly but surely putting money aside for darker times.

And by continuously investing the money I save each quarter, this is my current savings 4 years into it:

For some, this might not be much of a safety net. But for me, it’s 5427€ more than what I had before so a good start in my eyes.

Full disclosure, it’s not all from saving 2€ each day. But saving a bit each day has slowly but surely changed how I see myself and my beliefs about my ability to save. And that’s what really matters.

I used to think I was a person who was simply not good at saving money. But seeing that little message day after day changed that. I now see myself as a person who is somewhat financially stable and ‘smart’ with money. And believing this about myself has made me want to save more. So throughout these 4 years when I had a bit of money left over, sometimes rather than spending it, I put it into my savings account. And along the way, I increased the 2€ a day to 3€. But starting really small is what made it all possible.

The best habits are the easy ones. The great thing with this ‘habit’ (you could argue it’s not actually a habit) of course is that it requires no effort from me at all. And it has no noticeable effect on how much money I feel I have to spend each month.

The lesson here is that small changes over time can change our beliefs and identity. And once that happens, it can start to have a big impact on your behaviors.

Want to get better at saving? Here’s what you can do

Build a system that works for you

If you tried saving but it did not work that well, don’t give up, try something else. Make part of your money inaccessible or hard to get to. Compete with a friend on who can save the most in a year. Limit your spendings per day (for a couple of months, my wife and I were only allowed to spend 5€ each day. It gamified the whole thing and made it fun. Plus, it made you really think about what you wanted to spend your money on).

Start small & be in it for the long run

Small changes aren’t as exciting because you won’t notice the impact until much later. But with a bit of patience, it will be really rewarding once those rewards start to show. And you will be much more likely to be able to stick to it because small changes are manageable. What’s a tiny amount you can start with that will make no difference? That’s your start.

Focus on changing your beliefs

To really change a behavior, we need to change our beliefs around it. Be aware of what your current beliefs and identity around money and savings are.

What does a belief look like? “I suck with money”, “I will never afford my own place”, “I don’t have anything to save”. - All these are beliefs. Meaning not absolute truths but stories in your head you might have taken to be the truth.

Once you know your current beliefs and identity, think about who you would want to be instead. Your goal then is to change that belief and identity by acting differently. Once your beliefs change, other behaviors connected to that belief will change automatically and that’s when the real impact happens.

Testimonial about The 1-Month Habit Experiment

Need support to change your habits?

Around saving more, stressing less, or being kinder to yourself? Do like 250+ others and join The 1-Month Habit Experiment & equip yourself with tools & techniques to make changing your habits easier together with like-minded people who support you and hold you accountable. And since we are experimenting, you can’t really fail, only learn.